Author: Michael Gollob

-

2025’s Dirty Dozen Tax Scams

Although this year’s tax season is over, it is important to stay informed to avoid falling victim to these common tax scams.

-

Is the BOI Already Dead?

Is the BOI already dead? A federal judge has ruled that the Corporate Transparency Act (CTA) and its beneficial ownership information (BOI) reporting requirement are unconstitutional, but only for the National Small Business Association (NSBA) and its 60,000+ members as of March 1, 2024. The ruling, however, has the potential to have nationwide consequences as…

-

How to File an Extension for Your Tax Return

Are you ready for Tax Day? Need more time to prepare your federal tax return? Please be aware that an extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. You must file…

-

Beware of Scams This Tax Season

The IRS warns taxpayers to be wary of scam mailing that claims they are owed an “unclaimed refund”. These scams then request sensitive information from taxpayers including but not limited to detailed pictures of drivers’ licenses to commit identity theft and fraud. These scams can be recognized by awkward wording, requests for bank routing information,…

-

IRS Improvements to Assist Taxpayers

The IRS has released some new improvements to assist taxpayers this filing season. This includes expanding in person services and a reduction in wait times on the IRS toll-free call line with a new customer callback feature. There have also been improvements to online resources such as the “Where’s My Refund?” tool and the paperless…

-

Changes to 2023 Tax Deductions

The following annual adjustments are applicable to the 2023 tax year. You can read more on irs.gov.https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

-

2026 Proposed Senior Property Tax Changes

StayNJ is a recently finalized program aimed at assisting homeowners and renters 65 years of age and older in New Jersey. The fine details on filings & procedures are currently being ironed out. Click the link below for more details.https://www.nytimes.com/2023/06/21/nyregion/property-tax-cut-new-jersey.html

-

New Income Tax Brackets for 2023

The IRS has adjusted tax brackets, the standard deduction, and more for 2023 to adjust for inflation. See how you could be affected in the following article from CNBC: IRS: Here are the new income tax brackets for 2023

-

IRS Refunding Late Filing Penalties for 1040 & 1120 Returns

The IRS has announced that due to Covid-19, they will be issuing about $1.2 billion in refunds/credits for 1040 & 1120 filers who paid a late filing penalty. This could apply to you if you filed your 2019 return by August 1, 2020 or your 2020 return by August 1, 2021. Read the full article.

-

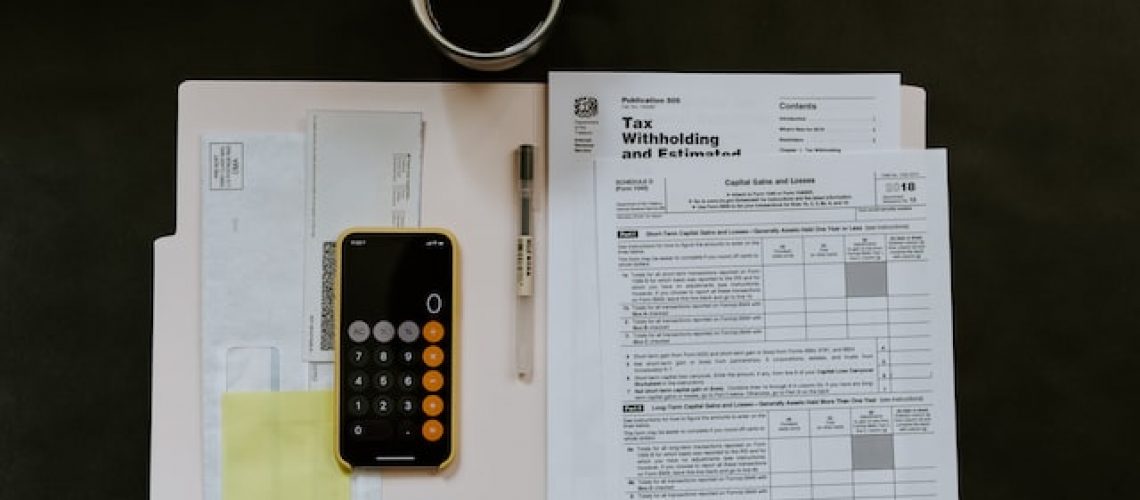

Are You Being Properly Withheld?

Did you know the IRS has a tax withholding calculator? You will be asked several questions about your filing status & your current place of employment. The only documents you need to help determine if you are being properly withheld are one of your most recent pay stubs, a recently filed tax return, and any…